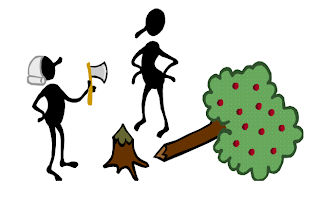

Closing Killers… 8 ways to avoid the AX

- A fully approved loan is no longer an approved loan if the buyer’s employment can’t be verified on the day of closing. If the buyer has had a change in employment the loan may have to be re-underwritten and a new settlement/closing date may need to be set.

- FHA requires 3.5% down payment by buyer. If the seller pays to much of the buyer’s closing cost, the loan will not be approved. Always check with the lender before you get to the final contract writing stage, to be sure on how much to ask for in seller paid closing cost.

- Make sure you get an appraisal early into the due diligence period. If the home does not appraise, it will more than likely not get a loan.

- If all necessary paperwork has not been sent to the lender in a timely manner the closing could be delayed.

- If the home is a short sale, even though the buyer and seller may have a fully executed contracted, bank approval is still needed before closing can take place.

- In a short sale, the second lien holder must also agree that the short sale transaction can take place.

- Any new applications for credit should be postponed until the buyer closes

- If you are on the selling side of the transaction, be sure to obtain a ‘Seller’s estimated net sheet’ to identify all cost and fees involved. Decide if you are willing to bring funds to close if the offer is not sufficient. Seller’s should also decide how much they are willing to pay in repair negotiations. A pre-inspection is a great starting point on figuring out what repair items the home may need. A pre-inspection also gives seller’s the chance to fix problems that could be discovered on the buyer’s inspection report.